Governance

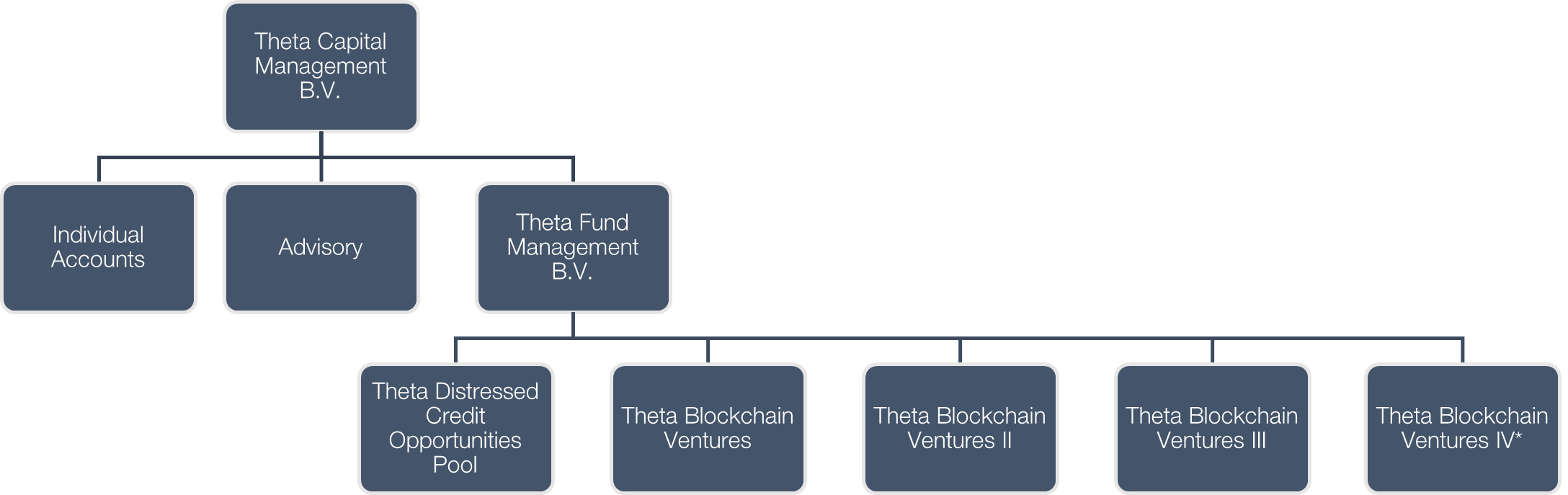

Theta Capital Management B.V. (“TCM”, KvK-nummer 34150519) and Theta Fund Management B.V. (“TFM”, KvK-nummer 27198870) operate collectively under the brand name ‘Theta Capital Management’. TFM is a wholly owned subsidiary of TCM, indicating a parent-subsidiary relationship. Within this corporate framework, each entity, TCM (MiFID II) and TFM (AIFMD), adhere to its respective regulatory requirements and operational procedures.

Theta Capital Management B.V.

Founded in 2001

Theta Capital Management B.V., founded in 2001, holds a license under section 2:96 Wft to act as an investment firm. This license allows TCM to perform the investment services ‘reception and transmission of orders’, ‘portfolio management’ and ‘investment advice’. TCM is registered with the AFM under license number 1400512.

TCM is established with the goal of providing tailored portfolios of best-in-class, dedicated, all-weather alternative investment specialists to professional investors, as well as advising on (co-) investment opportunities.

Governance at TCM is foundational, supported by a team of investment professionals and directors whose qualifications and abilities are vetted in accordance with AFM standards. The Directors’ of TCM bear overall responsibility, more specifically, they are responsible for formulating the strategic objectives, risk strategy and internal governance within the company. Likewise, they ensure the integrity of accounting and financial reporting systems and compliance with laws and regulations.

Theta Fund Management B.V.

Established in 2001

Theta Fund Management B.V., a 100% owned subsidiary of Theta Capital Management B.V. and part of the Theta Capital Management brand, was also founded in 2001. It operates with a license under Section 2:65 of the Wft; Alternative Investment Fund Managers Directive (AIFMD) license (number 15000174).

TFM is established to provide access to dedicated alternative investment funds with a specific theme for qualified investment professionals.

TFM’s governance aligns with the AIFMD guidelines. Strategic objectives, risk strategies and internal governance are set by the Board of Directors’, who bear overall responsibility. Additionally, a pivotal element in TFM’s governance is its Supervisory Board. In fulfilling its role, the Supervisory Board must consider the interests of TFM as well as the interests of all stakeholders, like clients and staff. This board plays a vital role in ensuring adherence to high standards of ethical conduct, regulatory compliance and to certain extent, steering the company’s strategic direction and its related risks. It also maintains oversight of the integrity of financial reporting and internal control . The SB meets quarterly.